TRUST AND FOUNDATION

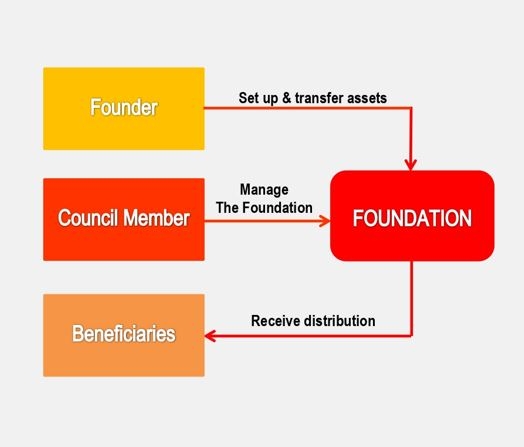

What is a Trust? A trust is a relationship where an asset is held by one party for the benefit of another. A trust is created by the owner "Settlor", who transfers property to at "Trustee”, the person / entity holds that asset for the “Beneficiaries.”

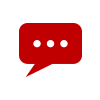

What is a Foundation? A foundation is a legal entity that has the capacity to execute rights and acquire obligations. A foundation is created by the “Founder” and generally has a purpose at preservations of assets for benefit of the “Founder” or “Beneficiaries”.

Benefits of a Trust/a Foundation

![]() Asset Protection. Assets under a Trust or a Foundation are beyond the reach of the Settlor's / Founder's creditors.

Asset Protection. Assets under a Trust or a Foundation are beyond the reach of the Settlor's / Founder's creditors.

![]() Privacy. Since trusts are not registered with the government, there are no public records about them.

Privacy. Since trusts are not registered with the government, there are no public records about them.

![]() Foreign Ownership.The Settlor / Founder/Benficiaries can be from any country and the asset can also be located in other countries.

Foreign Ownership.The Settlor / Founder/Benficiaries can be from any country and the asset can also be located in other countries.

![]() Tax Free. There are no corporate taxes or income taxes or any other tax. However, taxpayers whose government adopts global tax regime have to disclose all income to their tax authority.

Tax Free. There are no corporate taxes or income taxes or any other tax. However, taxpayers whose government adopts global tax regime have to disclose all income to their tax authority.

![]() Tax Planning. You can work with your local tax advisor to tailor a structure suitable for tax planning.

Tax Planning. You can work with your local tax advisor to tailor a structure suitable for tax planning.

Usual Structure

Jurisdiction Available

|

Seychelles Trust Fee: US$ 4,500 |

Nevis Trust Fee: US$ 4,900 |

|

Benefits

Key Features

|

Benefits

Key Features

|

|

Labuan Foundation Fee: US$ 4,900 |

Seychelles Foundation Fee: US$ 4,900 |

|

Benefits

|

Benefits

|

Application Procedure

|

Choose Trust or Foundation name and provide details of relevant Parties· Trust ( Settlor, Trustee, Beneficiaries, Protector) · Foundation (Founder, Council of Members, Beneficiaries) |

Provision of Due Diligence Requirements

|

Establishment |

Recommended Services:

Apply Online

Apply Online