Trust and Foundation

Trust and Foundation

INTERSHORES I Labuan Trust & Foundation

Importance of Wealth Planning

Asian businessmen are becoming more and more affluent – concept is new/unfamiliar

Engaging in cross-border activities/transactions and assets may be held as security

Increase in family-run businesses – multiple parties/generation

Desire for patriarchs and matriarchs of family businesses to decide the way forward

Increase in family feuds - disputes/decrease in value of business

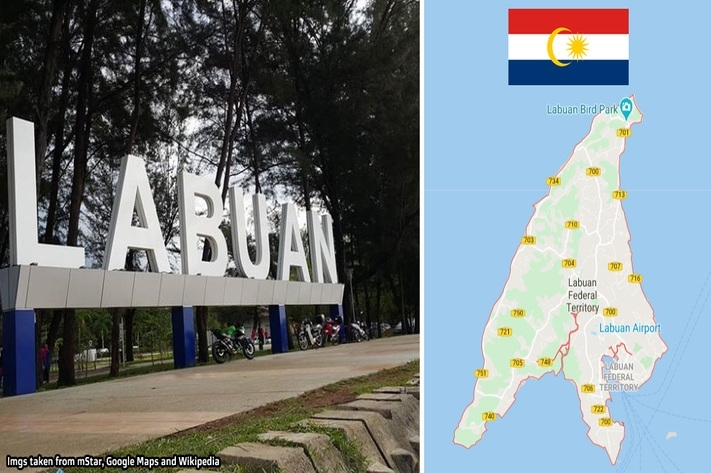

Wealth planning through modern structures via LABUAN TRUST A Labuan Trust is governed by the Labuan Trust Act 1996 (The Trust Act) which was updated in 2010. The legal concept involves regulating the relationships between the settlor, trustee and...

Details

INTERSHORES I Hong Kong Launches Network of Family Office Service Providers

Invest HK has launched a network of service providers mid June which designed to help promote Hong Kong as a preferred destination of choice for global family offices.

The Network of Family Office Service Providers brings together the relevant professional services providers, including private bankers, trustees, lawyers, accountants, wealth management professionals, etc, to create mutual business opportunities and promote Hong Kong's advantages to target markets.

The Network will seek to nurture a vibrant financial ecosystem that is able to access investments in Mainland China and the world, naturally makes Hong Kong as the “preferred choice of location for local and global...

Details

INTERSHORES 1 Incorporation Of Registered Trustee Corporation

Q: Who can apply for registration as a Trust Company ?

A: Any company, which is incorporated in Hong Kong and not a private company within the meaning of section 11 of the Companies Ordinance (Cap.622) (Note 1), may apply in writing to the Registrar of Companies to be registered as a trust company under Part 8 of the Trustee Ordinance (Cap. 29). The company should fulfill the following requirements:

the objects of the company as set out in its articles of association are restricted to some or all of the objects set out in section 81 of the Trustee Ordinance;

the issued share capital of the company is not less than HK$3,000,000 (Section 100 of the Trustee Ordinance provides...

Details

INTERSHORES I Registration Of A Non-Hong Kong Fund As A Limited Partnership Fund

Q: What is a Limited Partnership Fund (“LPF”)?

A: An LPF is a fund that is structured in a limited partnership form and will be used for the purpose of managing investments for the benefit of its investors.

Q: Is a Limited Partnership Fund (LPF) a legal person?

A: No, an LPF does not have a legal personality.

Q: Is registration of a Limited Partnership Fund “LPF”) under the Limited Partnership Ordinance (Cap 637) (“LPFO) compulsory ?

A: No, the LPF regime is an opt-in registration scheme which does not preclude other funds from operating in Hong Kong in the form of a limited partnership in parallel to a registered LPF.

Q: ...

Details

INTERSHORES I Registration & Re-domiciliation Of A Limited Partnership Fund In Hong Kong

The Hong Kong Limited Partnership Fund (LPF) governed under The Limited Partnership Fund Ordiance (Cap. 637) is very similar to the offshore limited partnership fund vehicles commonly used by assets management expertise.

A LPF constituted by a partnership agreement, a registered office in Hong Kong and with at least one general partner and one limited partner. Broadly, there is no regulatory approval required, no minimum capital requirements for the limited partners, no restrictions on investments, with flexibility in relation to freedom of contract and there are broad safe harbours.

Under the LPFO, the general partner (GP) has a duty to make a number of appointments,...

Details

INTERSHORES I A Nevis Trust - A Trust You Can Manage Your Own Assets Hassle Free

What Added Asset Protection Does a Nevis International Exempt Trust Offer?

Typically, a Settlor looks for a safe and stable jurisdiction to maintain their assets and seek to protect the Trust Property from future litigants, who may attack the Trust in the hope of setting it aside in order to have access to the Trust Fund. An attempt to attack a Trust could come from an array of complainants such as; a disgruntled Beneficiary, a divorcing spouse or a future creditor.

In the case of a Nevis International Exempt Trust, the Law states that:

A creditor must first pay a bond of US$100,000 to the Minister of Finance in Nevis, before brining any action or proceeding against a Trust and...

Details

INTERSHORES I Synergistic Effect Of A Trust Company To A Specialty Business Such as Securities Companies And More

A trust company is an entity that serves as an trustee to either a personal or business trust. The company will manage the trust and oversee the eventual transfer of assets to beneficiaries. A trust company isn’t limited to trust management . It can manage estates and custodial arrangements in addition to trusts and can also offer wealth management, asset management, brokerage and financial planning services. As fiduciaries, they have a legal mandate to act in the best interest of their clients at all times.

Specialty businesses such as securities companies, commodities businesses, assets management companies or money service operators, etc. always have a pain point – how...

Details

INTERSHORES I Benefits And Structuring Possibilities Of A Trust

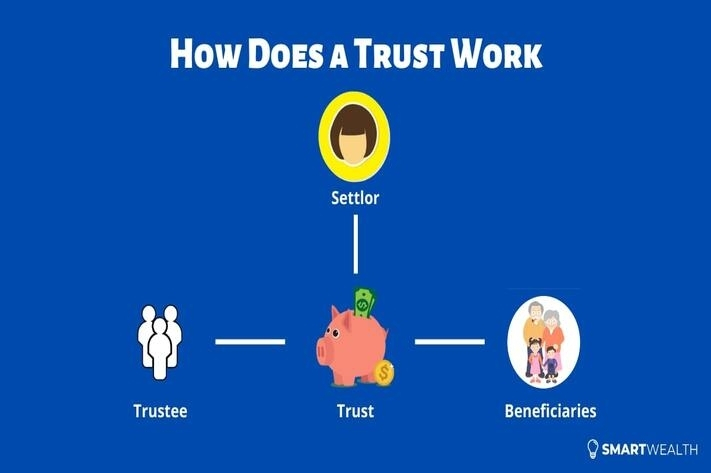

Trust is a fiduciary arrangement that the settlor transfers the assets to the trustee, and the trustee holds and manages the assets for the beneficiary according to the wishes of the settlor and the trustee can arrange the property effectively to the designated beneficiary. It works on dual ownership concept whereby the legal title is vested in one person (a trustee) and beneficial ownership vested in another (beneficiary). It is a popular vehicle and delivers much advantage.

Components of a trust

Settlor - a person who transfers rights and possession to the property owned by him.

Protector (optional) - a person who guides trustees in carrying out their duties as settlor...

Details

INTERSHORES I What is Labuan Foundation ?

Labuan Foundations, which is a statutory creature under the Labuan Foundations Act 2010 (LFA), are generally no different from foundations found in other jurisdictions where it is a separate legal entity that holds assets with the objective of managing the assets for the benefit of a class of persons on a contractual basis. Labuan Foundations are also typically used for private wealth management and charitable purposes. Labuan Foundations are in some aspects different from other jurisdictions such as Bahamas, Jersey and Seychelles. The following paragraphs discuss some similarities and certain distinctions.

Registered Office. Similar to the Bahamas and Seychelles, Labuan Founda...

Details

INTERSHORES I Factors in Selecting the Choice of Jurisdiction for Trust

Key Factors to Consider

Selecting the proper jurisdiction for the Offshore Trust is a matter of critical importance. As a general rule, the jurisdiction should have a well-established trust law favorable to asset protection strategies. Further, it should be inconvenient or nearly impossible for a creditor to reach the assets of the trust by commencing an action in the foreign country. Consider the following factors when selecting a jurisdiction for an Offshore Trust:

Ease of Communications

Communication with the foreign trustee must be convenient. Fortunately, the use of e-mail and fax as well as improvements in telephone technology have made communication with even the most...

Details