Labuan Company

Labuan Company

INTERSHORES I Labuan Company Benefits You Should Know

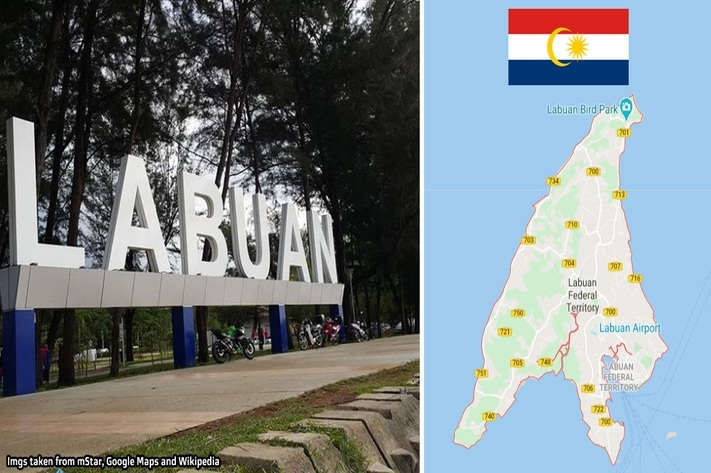

With a low attractive text regime, Labuan is one of the few offshore financial centers in Asia. It is also politically stable and economically strong. Hence, Labuan company benefits attract many foreign investors to set up a company in Labuan. If you are deciding whether to start a company in Labuan, it is important to understand the advantages of doing so. In this article, our team at Tetra Consultants has highlighted 6 Labuan company benefits you should know to help you with deciding whether to register company in Labuan.

1. Attractive tax regime

The low tax in Labuan allows Labuan to remain attractive for foreign investors to start a business. The corporate tax rate is 3% on...

Details

INTERSHORES i 6 Things To Know About A Labuan Holding Company

With a low attractive text regime, Labuan is one of the few offshore financial centers in Asia. It is politically stable and economically strong. Hence, attracting many foreign investors to set up a company in Labuan. If you are deciding whether to start a company in Labuan, it is important to understand the advantages of doing so.

Attractive tax regime

The low tax in Labuan allows Labuan to remain attractive for foreign investors to start a business. The corporate tax rate is 3% on annual net profits. This is relatively lower than the Worldwide Average Statutory Corporate Income Tax Rate of approximately 24%. There are zero taxes for non-trading offshore companies. In addition, there...

Details

INTERSHORES I Labuan Quick Fix

What makes Labuan different from other jurisdictions for Asian investors?

Labuan is part of Malaysia and is closer to Asian countries than many other jurisdictions. It has tax treaties with China, Hong Kong and Taiwan.

What types of companies can be incorporated?

The preferred company type is a company limited by shares, the Labuan Company. Protected Cell Companies, Limited Partnerships, Foundations and Trusts are also provided for.

What are the basic requirements for company formation in Labuan?

A company must have at least one(1) shareholder and at least one(1) director. Both of these may be resident outside of Labuan and Malaysia, and both can be corporate entities. There...

Details

INTERSHORES I Explore Asia's Protected Cell Companies Structure

The protected cell company (PCC) was borne as alternative risk management tool in 1997, designed primarily to cater for the needs of self-insuring organizations, especially the captive insurance industry. Apart from the captive insurance industry, PCCs are also now a popular structure in the fund management industry, as part of a larger diverse asset allocation investment strategy.

The core concept underpinning the PCC structure is that it acts as a single and separate entity which in turn has the ability to create multiple cells and provides these segregated cells the ability to take on differentiated assets and liabilities per cell, while allowing each cell to operate independently...

Details

INTERSHORES I Labuan to Navigate Your Business

With globalization and frequent cross-border activities, entrepreneurs have to readjust the way of doing businesses under Automatic Exchange of Information (AEOI) which allows tax authorities freely exchange information commencing from 2018. Along the line, more than 200 countries agreed to report their expatriates (non-residents) accounts through Common Reporting System (CRS).

In this context, it is essential for entrepreneurs to set up their businesses with real commercial substance than having a vehicle operating “virtually”. Labuan could be an alternative in provision of a midshore commercial operation in substance cost effectively to navigate your business dealings...

Details

INTERSHORES I Establishment and Operations of Labuan leasing business

The asset leasing industry in Labuan, which reached nearly USD1 trillion its overall global annual volume in 2017, has been undergoing numerous tax and regulatory changes. In the Asian region, in particular, the industry is expected to grow between 10% and 18% in the next five years. Levelling of the “international playing field” and the shrinking of regulatory arbitrage, Labuan International Business and Financial Centre (Labuan IBFC) has position as a Asian-based cost-efficient, substance-enabling midshore jurisdiction.

The Changes to Labuan Leasing Business and Operation

Background

A key driver to the introduction of the revised Guidelines effective from 2018 is to...

Details