|

The Court of First Instance (CFI) handed down a favorable judgement on the source of profits which held that booked profits are not subject to Hong Kong profits Tax. The case ruled that (1) the taxpayer did not carry on a business in Hong Kong and (2) its profits did not arise from commercial operations in Hong Kong. The profits are therefore offshore sourced and not chargeable to Hong Kong profits tax. The judegement upheld the principles of Hong Kong's territorial tax regime and reaffirmed the proper test for determining the source of profits as previously established.

In summary, the case reaffirms the determining factor and considerations for determining the source of profits. The taxpayer's own profit generating activities are important and the place(s) where the purchase and sale contracts are effected are the determining factors of the source of profits. Other considerations below should not be relevant:

1) a Hong Kong company is being up and used to facilitate / effect the transactions such as operating a bank account from outside Hong Kong and maintain a registered office in Hong Kong would not normally be regarded as carrying on a business in Hong Kong. 2) the suppliers are Hong Kong incorporated companies. 3) no tax is being paid overseas or the profits are not subject to tax in anywhere.

Nonetheless, determining the source of profit is a practical hard matter of fact. Each case must be evaluated based on its overall facts and circumstances.

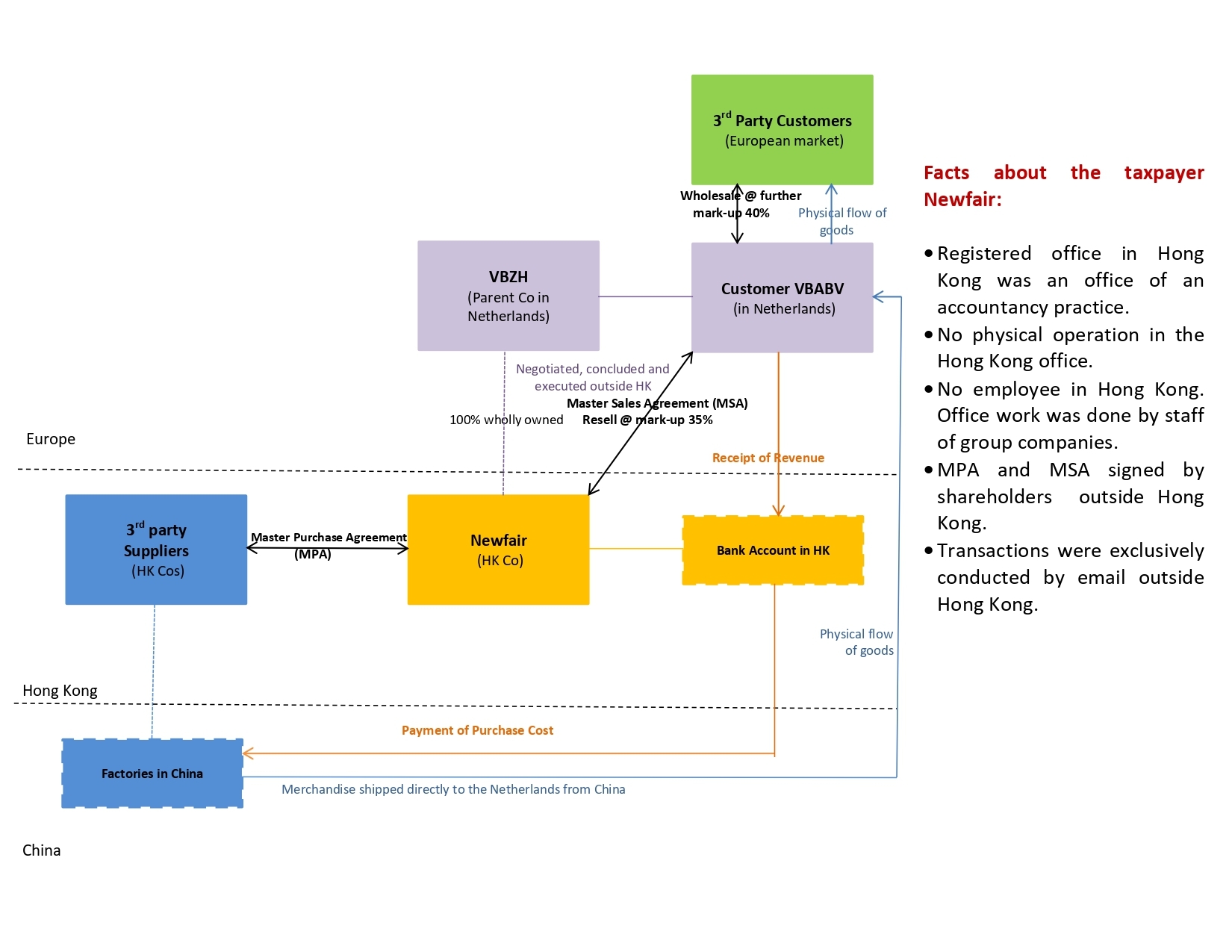

Background The taxpayer, Newfair Holdings Limited (Newfair), is a Hong Kong incorporated company within a group whose principal business was in trading of electronic products (the Products) sourced from manufacturers in the Far East to the European market. Newfair is wholly owned by a Dutch company VBZH located in Netherlands.

The Products were sourced pursuant to a master purchase agreement (MPA) by Newfair from two independent Hong Kong suppliers (the Suppliers), whose production base was in China. Newfair then on-sold the Products to its fellow group company VBABV in the Netherlands under a master sales agreement (MSA).

Both the MPA and MSA were negotiated and concluded by a shareholder of VBZH on behalf of Newfair outside Hong Kong. Purchase prices of the Products under individual orders drawn down from the MPA were determined through negotiation between the shareholder of VBZH and the Suppliers outside Hong Kong.

When the terms of the orders were agreed, the purchasing manager of VBABV based in the Netherlands, would attend to the follow up work with the Suppliers by email. The manager was also responsible for all the business operations of Newfiar, including the operation of the Hong Kong bank account which paid the suppliers and received all the sales proceeds.

The Products were shipped directly from the factories of the Suppliers in mainland China to VBABV in the Netherlands. Newfair would sell the Products at a mark-up of about 35% to VBABV, which in turn, distribute the Products on a wholesale basis to customers in the European market a the further mark up of about 40%.

The case is about the CFI dealt with the appeal lodged by the taxpayer against the Board Of Review (BOR)’s decision. CFI judgement contained the following decisions:

1. grant leave to appeal to the taxpayer 2. allow the taxpayer’s appeal on the two substantive issues involved.

The Two Substantive Issues Issue 1: Whether Newfair was carrying on a trade or business in Hong Kong?

The BOR's Decision The Board concluded that Newfair carried on a business in Hong Kong based on the three “Pivotal Factors” :

1. a Hong Kong bank account was used to receive sales proceeds and paid the Suppliers (Pivotal Factor 1). 2. the Suppliers were all Hong Kong incorporated companies managing the shipments from Hong Kong (Pivotal Factor 2). 3. the establishment and interposition was drawn from the MSA that the contracting parties intended Hong Kong to be the principal place of business, where the acceptance of the orders was supposed to take place (Pivotal Factor 3).

The CFI's judgement The CFI held that Newfair did not carry on a business in Hong Kong based on the following grounding:

1. “carrying on of business” usually calls for some activities on the part of the taxpayer in the pursuit of commercial gains. The operations that gave rise to Newfair’s profits were sales of goods and all merchandise contracts were concluded outside Hong Kong. The activities of receipt and paying the suppliers (Pivotal Factor 1) were only incidental administrative acts and not the revenue generating activities – both activities could not show a business was carried on in Hong Kong. 2. The locality of the Suppliers’ business was irrelevant in determining whether Newfair was carrying on a trade or business in Hong Kong (Pivotal Factor 2). 3. Designating a principal place of business was not the same as identifying the place whether the profits actually arose. There was no finding that the acceptance of the orders in fact took place in designated principal place of business in Hong Kong (Pivotal Factor3).

Issue 2: Whether Newfair’s profits were arising in or derived from the Hong Kong ?

The BOR's decision The Board concluded Newfair’s profits were derived from Hong Kong due to the following grounding:

1. Newfair actively operated its Hong Kong bank account to pay the Suppliers and received proceeds. Such banking transactions were causative of the profits earned by Newfair. 2. Newfair held title to the Products on-sold to VBABV, which amounted to valuable assets held by Newfair in Hong Kong. 3. The establishment and interposition of Newfair would enable the VBZH group to achieve fiscal advantages of having a portion of mark-up escape taxation in the Netherlands. Newfair’s business model did amount to identifiable profit-generating activity.

The CFI's judgement The CFI applied the various principles established in the case law on source of profits and held that Newfair’s profits were not sourced in Hong Kong. In particular, the CFI pointed out that:

1. profits arising from merchandise trade should be taken as arising in or derived from the place where the contracts of purchase and sale were effected. Considering all the commercial operations relevant to the profit-generating transactions were the purchase of goods from the Suppliers and the resale of the same at a fixed mark-up to VBABV, and the negotiations and conclusion of the purchase and contracts were effected outside Hong Kong. The operation of the Hong Kong bank could not amount to profit-producing operation, but an incidental act done after formation of the profit-generating contracts of purchase and sale. 2. There was no evidence in support of the conclusion that Newfair’s legal title to the Products on-sold by Newfair to VBABV amounted to valuable assets held by Newfair in Hong Kong. 3. the tax planning arrangement undertaken by the VBZH group was not a commercial operation that generates profits.

Given the above, the CFI judge overtuned the BOR decision, holding that Newfair did not carry on a trade or business in Hong Kong and the products derived from its business activities conducted outside Hong Kong not chargeable to tax.

Whatsapp : (852) 6499 4686 Phone : (852) 2186 6936 Email : info@intershores.hk

Disclaimer: Whilst reasonable care has been taken in provision of information above, it does not constitute legal or other professional advice. INTERSHORES does not accept any responsibility, legal or otherwise, for any error omission and accepts no responsibility for any financial or other loss or damage that may result from its use. In particular, readers are advised to take appropriate professional advice before committing themselves to any involvement in jurisdictions, vehicles or practice. |

|