HK Co Set Up

HK Co Set Up

INTERSHORES I Statistics Of Hong Kong Companies

Upto Nov 2022, the number of Hong Kong companies that has remained registered on the Companies Register is 1,394,191 which includes 918a public companies, 1,376,922 private companies and 16,351 guarantee companies.

The number of companies incorporated in 2022 is 95,909, including 36 public companies, 94,970 private companies and 903 guarantee companies.

Whatsapp : (852) 6499 4686

Phone : (852) 2186 6936

Email : info@intershores.hk

Disclaimer:

Whilst reasonable care has been taken in provision of information above, it does not constitute legal or other professional advice. INTERSHORES does not accept any responsibility, legal or otherwise, for any error omission and...

Details

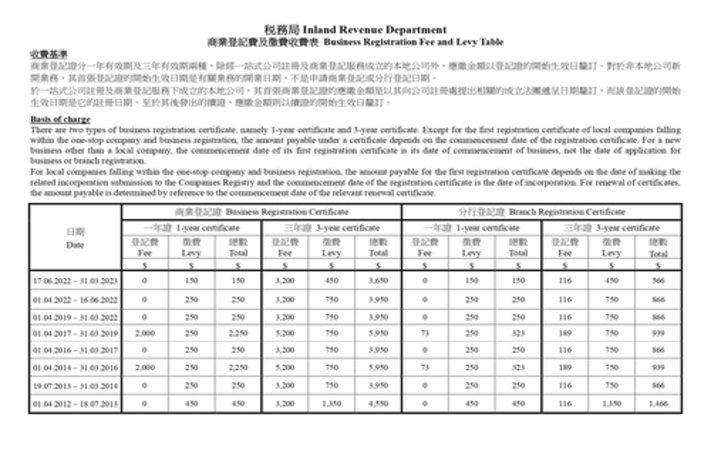

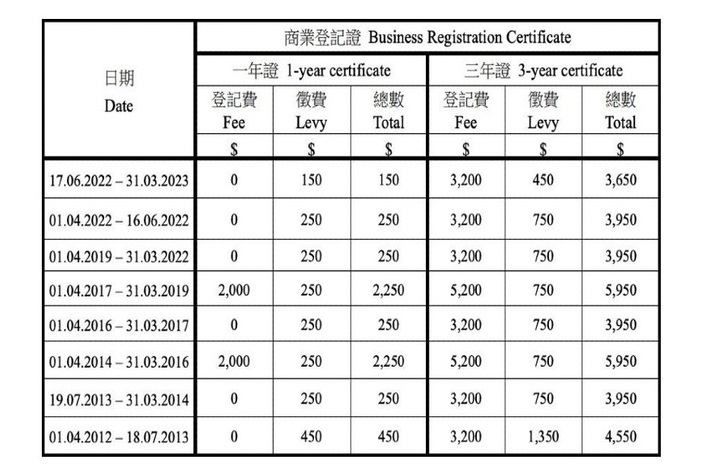

INTERSHORES I Low BR Levy For A HK Co. Till 31 March 2023

The levy rate of Business Registration rate for a Hong Kong company remains as HK$150 till 31 March 2023. Take good use of low rate incentive in the assessable year offered by the Hong Kong government.

Contact our team below to discuss your business needs and set up.

Whatsapp : (852) 6499 4686

Phone : (852) 2186 6936

Email : info@intershores.hk

Disclaimer:

Whilst reasonable care has been taken in provision of information above, it does not constitute legal or other professional advice. INTERSHORES does not accept any responsibility, legal or otherwise, for any error omission and accepts no responsibility for any financial or other loss or damage that may result from its...

Details

INTERSHORES l Reduced Business Registration Fee For A Hong Kong Company

The Business Registration Ordinance (Amendment of Schedule 2) Order 2022 ('the Order') of Hong Kong was gazetted on 10 June 2022. According to the Order, the levy rate for setting up a company be reduced from HK$250 per annum to HK$150 per annum. This reduced new levy rate is applicable to:

1) the incorporation submissions in relation to simultaneous business and registration applications made on or after 17June 2022; and

2) all other cases, if the commencement date of business or branch registration certificates is on or after 17 June 2022.

Take advantage of the reduceed business registration fee and talk to Intershores' team as below :

Whatsapp : (852) 6499 4686

Phone :...

Details

INTERSHORES I Benefits To Open Offshore Company In Hong Kong

What are the advantages of an offshore company in Hong Kong?

1. Tax system

i. Businesses in Hong Kong are subjected to a Profits Tax Rate of 8.25%for the first assessable profits of HK$2million and thereafter 16.5% on the locally sourced income, which is lower than the worldwide average corporate tax rate of 23.85% measured across 177 jurisdictions.

ii. Hong Kong offshore company tax system is simple and beneficial for businesses. Businesses are completely exempted from tax on foreign income, capital gains tax, and withholding tax on dividends or interests.

iii. The government has an extensive network of Double Tax Agreements with over 45 countries.

2. Effective...

Details

INTERSHORES I How to Chose Your Hong Kong Incorporation Package

Hong Kong technically is not an offshore jurisdiction but somehow an offshore-like jurisdiction with the benefits that outperform the others attracting large number of businessmen to come here for business. Hong Kong private company limited by shares is the most feasible business entity for entrepreneur to setup as the owners/directors do not have to be present in Hong Kong for incorporation. Before you decide to set up a Hong Kong company with a specific services provider. You may have to consider the following :

Buy a shelf company or tailor made a new company?

What is Shelf Company?

Shelf company (also named as off the shelf or ready-made company or stock company) is simply a...

Details

INTERSHORES I Be Specific in Your Business Nature

Before you start your business, you always think about your business model & activities and how to make money out of them. This is what is interested by the authority as well!

We used to say that you should keep your business nature very brief or so to speak sometimes vague limiting to “Corporation”, “Trading”, “Consulting”, “Holding” when you set up your Hong Kong company. You should now need to simply elaborate more on your business activities. For example, instead of “Trading”, you should report to the Business Registration Office as “Trading in Electronics” or “Consulting” to become “IT...

Details

INTERSHORES I Building The Future Through Asia - HK (Experience Sharing)

Design consultancy CallisonRTKL was formed in 2015, under the global engineering consultancy Arcadis. With 1,700 professionals working across 24 offices worldwide, CallisonRTKL specialises in architecture, interior design and urban design through four major practice groups – commercial, retail stores, healthcare and workplace.

Darryl J. Custer, Regional Practice Group Leader, South Asia, Commercial, sees Hong Kong as a market unto itself but also a bridge between Mainland China and Southeast Asia. “We have a long history in Asia and have been very successful in Mainland China, but we are seeing renewed activity throughout Southern China and Southeast Asia,” he said.

...

Details

INTERSHORES I Structuring Your Holding Vehicle For Your China Venture

When structuring your investment into China, it is not only important to consider different vehicles available in China (e.g. a representative office, a joint venture or a wholly foreign-owned enterprise) but also the jurisdiction through which the Chinese vehicles is held. You can use your existing company or set up a special purpose vehicle (“SPV”) to remove your venture risk. By SPV, you have a choice of using offshore jurisdictions (such as British Virgins Islands, Seychelles, Mauritius, Samoa or Labuan, etc.) or Hong Kong to hold the China investment. We would like to outline the differences between using offshore or Hong Kong companies as your China SPV:

Using...

Details

INTERSHORES I How to Structure Your Business in Hong Kong

If you want to set up a business in Hong Kong, you should first of all think of how to structure your business.

The common form of entities include private limited company, branch office (for overseas company), representative office, sole proprietor and partnership. The overview below assists you to decide which suits you most:

Private Limited Company

A private limited company is the most common form of entity in Hong Kong. Though more expensive and with basic statutory compliance at set up, on annual (please refer to condensed fact sheet on the website) and at close down that one has to fulfill, the benefits outweigh the disadvantages:

1. A separate legal entity (can own...

Details

INTERSHORES I Top Reasons to Setup a Company in Hong Kong

1. Located at the heart of Asia. Hong Kong enjoys an enviable location. One can reach half of the world's population in just five (5) hours' flight time. It is strategically located at the heart of Asia, next to China and other Belt & Road countries easily.

2. Setting up a business in Hong Kong is quick & easy. Incorporation can be completed within a day.

3. 100% foreign ownership.There are no restrictions as to the nationality of the owner.

4. No Foreign Exchange Control.

5. Free flow of capital as an international financial centre.

6. Can do and operate business anywhere in the world.

7. Can open bank accounts anywhere in the world.

8. No...

Details

INTERSHORES I Guide to Form an Offshores Company in Hong Kong

Although Hong Kong does not have any specific law that governs offshore company formation, it is one of the most popular jurisdictions for setting up an offshore company owing to its low tax regime, absence of foreign exchange controls, political and economic stability, ease of offshore company setup, etc. Setting up an offshore company in Hong Kong is the perfect vehicle for conducting offshore banking activities, international trade, investment activities, and for asset protection.

This guide sets out the advantages of Hong Kong incorporation, the options for registering an offshore company in Hong Kong, Hong Kong Offshore Company formation requirements and Hong Kong incorporation...

Details

INTERSHORES I Business Activities For HK Company

Whatever business you are planning for your Hong Kong company, you need to declare to the authorities – the Business Registration Department via Companies Registry at incorporation) and the bank at bank account opening.

At Incorporation, Make it Simple.

The Companies Registry will not ask you for your business details. A simple description that is able to ascertain the industry involved is the best. Activities description such as consulting, trading, investment, holding, investment holding, manufacturing, retail, etc. can serve the purpose.

You should note that,

1. your business activity will appear on the Business Registration Certificate.

2. the length of...

Details