|

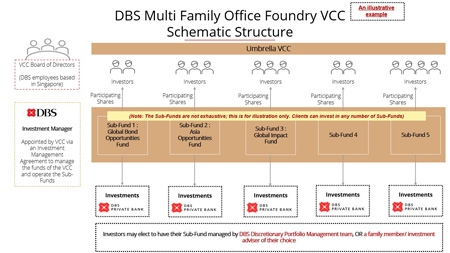

Amid rising interest from ultra-high net worth (UHNW) families around the world to set up family offices in Singapore, DBS Private Bank has launched in end June 2023 the DBS Multi Family Office Foundry VCC (DBS MFO), the world’s first bank-backed multi family office that leverages Singapore's Variable Capital Company (VCC) structure. This new platform is established as an umbrella VCC, with multiple underlying sub-funds that clients can use to manage their assets. It offers an alternative option for affluent families to manage their wealth in Singapore, without having to establish their own Single Family Office (SFO).

Through DBS MFO, clients will be able to access a full suite of investment services - from investment management, trade execution, to custody solutions - via a single integrated platform. Clients can elect to either have their sub-fund professionally managed by the DBS Discretionary Portfolio Management (DPM) team, or by a family member/ an investment adviser of their choice.

Benefits of investing through DBS MFO include:

It is an attractive option for some families who are not looking to immediately relocate to Singapore, but would like to consolidate their assets there.

There are around 1100 SFOs in mid July 2023. DBS Singapore has around 240 SFOs.

Whatsapp : (852) 6499 4686 Phone : (852) 2186 6936 Email : info@intershores.hk

Disclaimer: Whilst reasonable care has been taken in provision of information above, it does not constitute legal or other professional advice. INTERSHORES does not accept any responsibility, legal or otherwise, for any error omission and accepts no responsibility for any financial or other loss or damage that may result from its use. In particular, readers are advised to take appropriate professional advice before committing themselves to any involvement in jurisdictions, vehicles or practice.

|

|